#

#

Evaluating Risk-Management Strategies across Assets

We evaluate a variety of strategies across a number of crypto-currencies.

Strategies of interest include Volatility Control (VOL CTL), Drawdown Control (DD CTL), CPPI, Time-Series Momentum (TSM), Moving Averages (MA) with a 5 day short window, and a Bag of Strategies approach including both Drawdown Control and Moving Averages (BoS).

Assets of interest include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Dogecoin (Doge), Polygon (MATIC), Avalanche (AVAX), Cadrano (ADA), Filecoin (FIL), Hedera Hashgraph (HBAR), Ripple (XRP), Chainlink (LINK), Sandbox (SAND), and Axie Infinity (AXS).

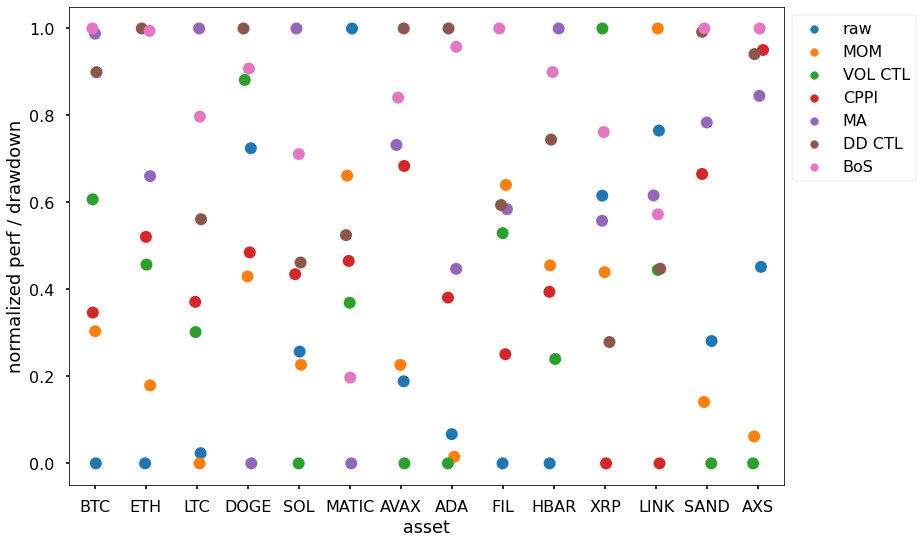

The graph below plots the performance to drawdown ratio of each strategy applied to each cryptocurrency, as well as the raw performance of the cryptocurrency. We scale the performance linearly so that the best performing strategy is assigned a score of 1, while the worst strategy is assigned a score of 0.

Three strategies come out strongly Balanced Drawdown Control, Moving Averages, and the Bag of Strategies approach. This is summarized in the table below. For each strategy, it reports the number of assets for which the strategy is within 20% of the performance of the best strategy. BoS is within 20% of the best strategy for 9 assets, DD CTL does so for 7 assets, and MA does so for 5 assets.

The next table describes strategies' tendency to perform poorly. For each strategy, it reports the number of assets for which the strategy is within 20% of the worst strategy. This is never the case for DD CTL, once for BoS, and twice for MA and CPPI.

On the basis of these results, we find drawdown control a good basis for our portfolio construction. A Bag of Strategies approach increasing the range of underlying strategies also seems promising. The performance of MA is intriguing, but MA is not primarily a risk-management strategy and there are environments in which it performs badly.