#

#

Risk-management across market scenarios

Risk-management is a good idea over the medium run. However, because risk management is a compromise between no risk and full risk, there is always room for regret over the short-run: if markets boom, full risk looks better; if markets crash, zero risk looks better. A principled investor must anticipate these feelings of regret to stay the course over the market's bull and bear cycle.

One useful way to do so is to explore step-by-step how using a drawdown control strategy on Bitcoin would have felt over the 2021-2023 cycle.

#

Overall Drawdown Control Adds Value

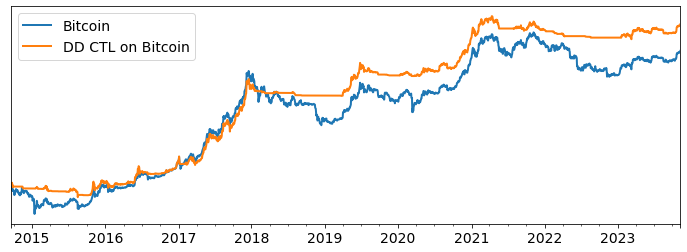

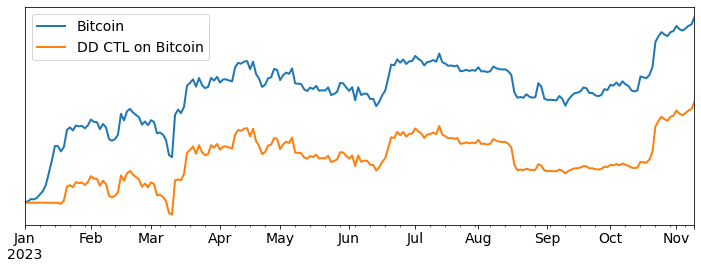

The figures below illustrate that a drawdown control strategy significantly improves the risk-reward profile of Bitcoin from 2015 to 2023, but also from 2021 to 2023

Indeed, over 2021-2023, Bitcoin yielded an average return of 8% for a worst-case drawdown of 77%. In contrast, balanced drawdown control applied to Bitcoin yielded an average return of 16% for a worst-case drawdown of 53%. So overall, using using balanced drawdown control is a good idea over this period. It beats Bitcoin alone, and it beats the safe asset.

Lets now look at how the strategy performs over one year periods.

#

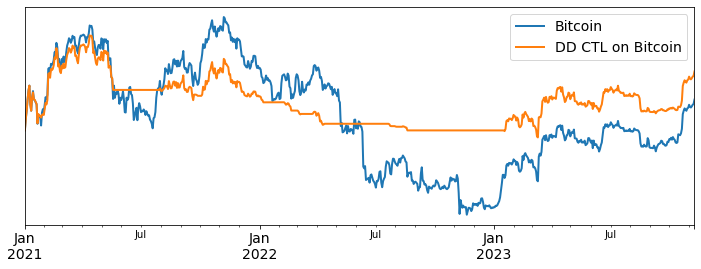

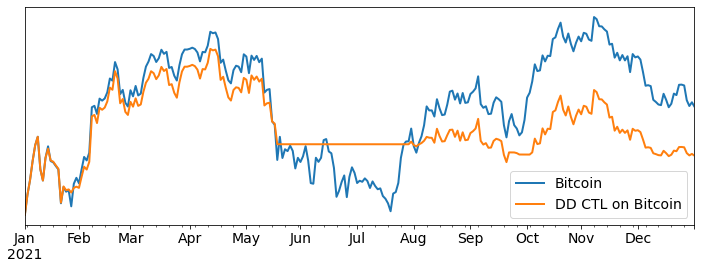

Year 1: Sideways Market

As the figure below illustrates 2021 was a sideways market for crypto. In such a market, it is difficult for Drawdown Control to do much better than the underlying asset, and whether it comes ahead or behind is essentially a toss-up. In this case it came out behind. Specifically, in 2021, Bitcoin generated a return of 60% for a worst drawdown of 53%, while Drawdown Control generated a return of 30% for a worst drawdown of 38%.

In this case, an investor would feel intense regret with respect to Bitcoin.

#

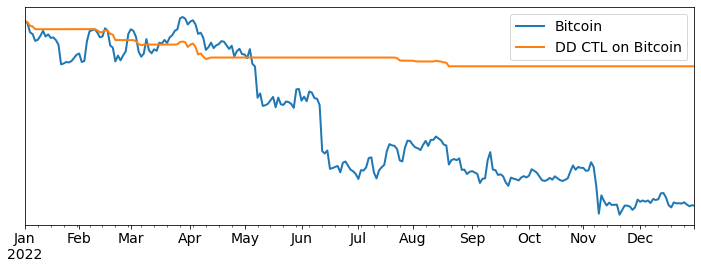

Year 2: Crash

In 2022 the market crashed. This is where Drawdown Control helps. Bitcoin lost 64% of its value, while Drawdown Control lost only 22%.

In this case, an investor would feel regret for cash.

#

Year 3: Boom

In 2023, the market boomed. Drawdown Control was able to get back into the market, but it's a progressive process, resulting in foregone returns compared to Bitcoin. Specifically, Bitcoin generated a return of 122%, while Drawdown Control generated a return of 54%.

Once again, this is a case where an investor would feel intense regret for Bitcoin.

#

Back to Compounding

How can it be that Drawdown Control does better than Bitcoin overall, and yet performs much more poorly 2 out of 3 years. The answer is compounding. As we saw earlier on, losses weigh larger than gains when you are compounding.

Remember, if you invest 1 dollar, gain 10% and lose 10% you are not back to 1 dollar, your now have 99 cents (.9 * 1.1 = .99). Things get worse as the losses get bigger.

In this case, a dollar invested in Bitcoin in 2021 becomes

(1 + 0.60) \times (1 - 0.64) \times (1 + 1.22) = 1.28 \text{ Dollars}

While a dollar invested in Drawdown control in 2021 becomes

(1 + 0.3) \times (1 - 0.22) \times (1 + 0.54) = 1.56 \text{ Dollars}.

For medium run investors, who seek to compound, asset protection is more important than chasing gains.

This is why we built Lucid.