#

#

Volatility Targeting

Volatility Targeting, or Volatility Control, is a prominent risk-management strategy that seeks to keep the volatility of a portfolio close to a target level by appropriately scaling the portfolio's exposure to the underlying risky asset of interest.

For instance, if the Nasdaq has volatility 25% and you want a portfolio with 15% volatility, you could invest 60% = 15/25 of your assets in the Nasdaq and 40% in cash, or treasury bills. The resulting portfolio will have volatility 15%.

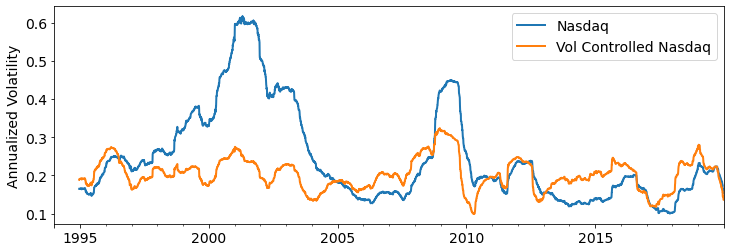

This risk-management strategy is useful when the underlying asset of interest has time-varying volatility: relatively quiet times alternate with more agitated times. This allows an investor with a fixed risk-appetite to keep a stable risk exposure. The Figure below plots the annualized rolling volatility of the Nasdaq, and of a Volatility Controlled version of the Nasdaq seeking to target an annual volatility of 20%. Because the Nasdaq has an average yearly volatility of 27% over the 25 years from 1994 to 2019, the Volatility Controlled Nasdaq has a reduced exposure to risk, but it quiet periods where the Nasdaq has a volatility less than 20%, Volatility Control may actually use some leverage (i.e. borrow to buy more) to increase its risk exposure. It's common to limit the maximum leverage, for instance to 25%.

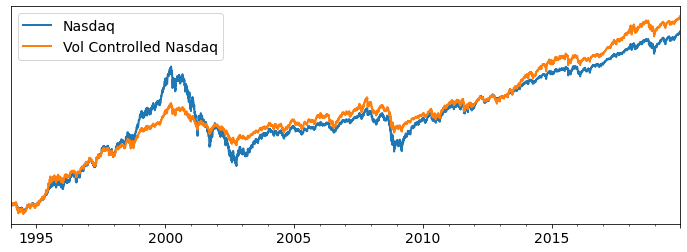

A surprising finding is that volatility control can increase the risk-reward ratio (and potentially the performance) of a particular asset class. As the Figure below shows, this is the case for Nasdaq.

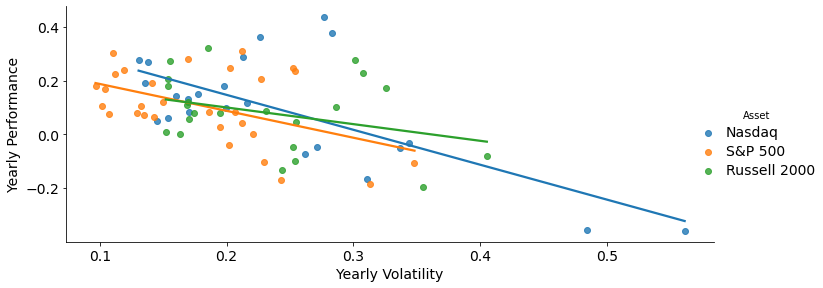

This is surprising, because simple economic theory suggests that expected returns should increase during agitated times to compensate for the increased risk, but in many markets, it's just not the case. In fact, for equity it's the opposite. Periods of high volatility tend to be periods with low returns. The Figure below shows the relationship between volatility and returns for rolling 2 year periods across the S&P 500, the Nasdaq, or the Russell 2000. Volatility and returns tend to be negatively correlated. This means that investors tend to be poorly rewarded for high volatility. This makes a strategy like volatility control attractive.

#

Volatility and Crypto

With crypto, volatility is par for the course. Between 2017 and 2023, the volatilities of the S&P 500 and Nasdaq were respectively 19% and 24%. The volatilities of Bitcoin and Ethereum were 74% and 92%.

However, with crypto volatility is kind of the point. Over 2017--2023, all four assets have similar risk-reward ratios. The Sharpe ratio of the S&P 500 is .63, Nasdaq's is .8, Bitcoin's is .84, and Ethereum's is .74. However, as an investor, you don't get to spend risk-reward ratios, you only get to spend the compounded returns. This means that keeping risk-reward ratios the same volatility can sometimes be your friend.

Recall that Sharpe = Average Return / Volatility. This means that Average Return = Sharpe \times Volatility. Keeping the Sharpe ratio fixed the way you enjoy returns is by increasing volatility.

That's the attraction of crypto for investors: It offers a good Sharpe ratio, and a very large volatility.

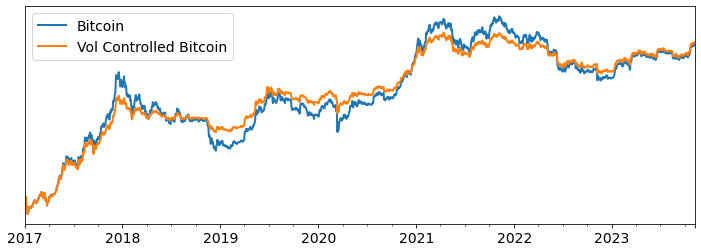

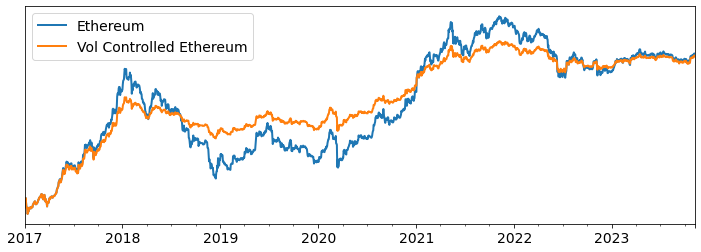

Volatility Control is still valuable, but only makes sense if an appropriate volatility target is chosen. The figures below represent the returns of a Vol Control strategy targeting a 50% volatility applied to both Bitcoin and Ethereum. In both cases, Volatility Control reduces drawdowns and volatility without noticeable reducing returns.

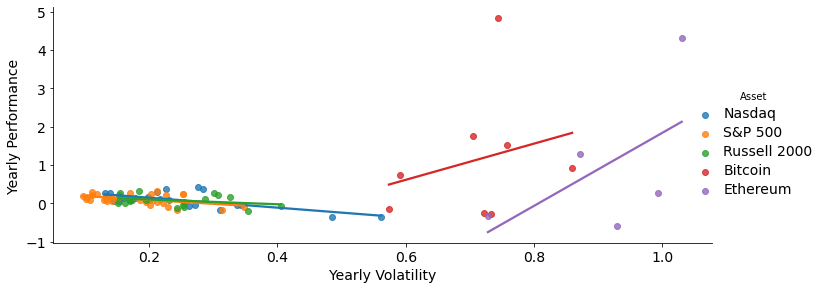

However, one fact suggests that it may be possible to improve on Volatility Control. The figure below plots the relationship between Annual Performance and Volatility for equity indices, bitcoin and ethereum. Unlike equity indices, crypto's returns seem to be increasing with volatility. This means that for crypto, bull markets can also be associated with high volatility. Our preferred risk-management strategy treats risk in a bull market differently from risk in a bear market.