#

#

Risk-Managed TOP5

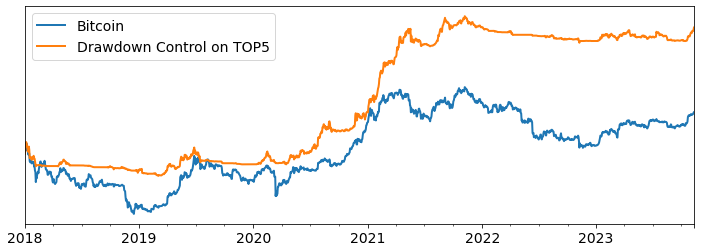

Our Risk-Managed TOP5 Index applies Balanced Drawdown Control to each of the TOP5 cryptocurrencies by market cap excluding stablecoins, and aggregates individual asset allocations using regular rebalancing.

Current underlying risky assets are Bitcoin, Ethereum, Ripple, BNB, and Solana. The safe asset is USD.

graph LR

A(Bitcoin) --> B(Drawdown Control)

C(Ethereum) --> D(Drawdown Control)

E(Ripple) --> F(Drawdown Control)

G(Solana) --> H(Drawdown Control)

I(Cardano) --> J(Drawdown Control)

B --> Z(Regular Rebalancing)

D --> Z(Regular Rebalancing)

F --> Z(Regular Rebalancing)

H --> Z(Regular Rebalancing)

J --> Z(Regular Rebalancing)

#

Backtested Returns

Over 2018-2023, the strategy generates a return of 68%, with a maximum drawdown of 55%, and a Sharpe Ratio of 1.3.

| month | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| year | |||||||||||||

| 2018 | -0.10 | -0.16 | -0.01 | 0.10 | -0.08 | 0.00 | -0.02 | -0.02 | 0.01 | -0.03 | -0.04 | -0.03 | -0.34 |

| 2019 | -0.06 | -0.04 | 0.12 | 0.06 | 0.35 | 0.13 | -0.21 | -0.02 | -0.04 | -0.00 | -0.02 | 0.00 | 0.18 |

| 2020 | 0.09 | 0.00 | -0.05 | 0.16 | 0.07 | 0.06 | 0.41 | 0.46 | -0.19 | 0.00 | 0.50 | 0.04 | 2.50 |

| 2021 | 0.46 | 1.11 | 0.22 | 0.70 | -0.11 | -0.10 | -0.02 | 0.62 | -0.05 | 0.16 | -0.05 | -0.10 | 6.62 |

| 2022 | -0.08 | -0.03 | -0.00 | -0.06 | 0.00 | -0.03 | -0.00 | -0.06 | -0.01 | -0.00 | -0.04 | -0.01 | -0.28 |

| 2023 | 0.15 | -0.04 | 0.09 | -0.03 | -0.03 | -0.03 | 0.04 | -0.12 | -0.00 | 0.18 | 0.15 | NA | 0.38 |